From utility maintenance to construction or arboriculture, we can’t deny that van cherry pickers are an indispensable specialised MEWP. However, with their unique capabilities come some unique risks. Subscribing to insurance thus becomes a necessity. More than that, it’s a matter of responsibility. As the leading van cherry picker manufacturer in the UK, we’d like to delve into the nuances of van cherry picker insurance, guiding you through its importance, types of coverage, and key considerations for choosing the right policy.

Why is insurance essential for a cherry picker van?

Operating a van cherry picker without proper insurance can be a high-stakes gamble. In the event of an accident or equipment damage, the financial repercussions can be severe. Legally, insurance is often a mandatory requirement, ensuring that both the operator and third parties are protected against potential liabilities. More than a legal formality, this insurance serves as a safety net, safeguarding your business finances and reputation against unforeseen events.

Types of cover for Van Cherry Pickers.

Types of cover for Van Cherry Pickers.

Insurance for van cherry pickers typically encompasses several types of cover. Liability insurance is fundamental, covering damages or injuries caused to third parties like :

- Damage to property caused by your vehicle

- Theft while it’s out in the open

- Theft during the night

- Ongoing hire charges

- Accidental damage

- Malicious damage

- Road risks

What are the factors influencing insurance premiums?

When it comes to insurance premiums for Van Cherry Pickers, several factors come into play. The model and age of the cherry picker can significantly affect the cost, with newer and more sophisticated models generally attracting higher premiums. The frequency of use and the operator’s experience and history are also factors to consider. Understanding these can help you in negotiating better terms and possibly reducing premiums, such as through safety training for operators.

Let’s delve deeper with a few examples.

Model and age of the Cherry Picker.

A brand-new K38p model, known for its 13.8m working height and advanced safety features, will typically have a higher insurance premium compared to an older, less sophisticated model. This is because newer models often incorporate the latest technology, which can be more expensive to repair or replace.

Frequency of use.

A cherry picker used daily for high-rise construction work presents more risk due to the increased exposure to potential accidents. This usage pattern can lead to higher premiums because the probability of filing a claim is higher.

Conversely, a Cherry Picker used occasionally, say, once a month for light maintenance or signage work, poses less risk. This infrequent usage can result in lower insurance premiums as the likelihood of accidents and wear is reduced.

Operator’s Experience and History.

An operator with several years of experience and a clean safety record will be viewed more favourably by insurance companies. For instance, an operator who has used various models like the K38p without any accidents or major incidents over a five-year period is likely to contribute to lower premiums.

On the other hand, a novice operator or someone with a history of accidents or safety violations could increase the insurance premium. For instance, if an operator was involved in two minor accidents over the past year, this could be an indicator of higher risk, leading to increased premiums.

Impact of safety training.

Providing operators with regular safety training can be a game-changer. Imagine you invest in annual safety workshops, focusing on best practices for operating high-end models of van mounted cherry pickers, you demonstrate a commitment to reducing risks. Insurance companies might offer lower premiums to such companies as their operators are less likely to be involved in accidents.

Choosing the right insurance provider

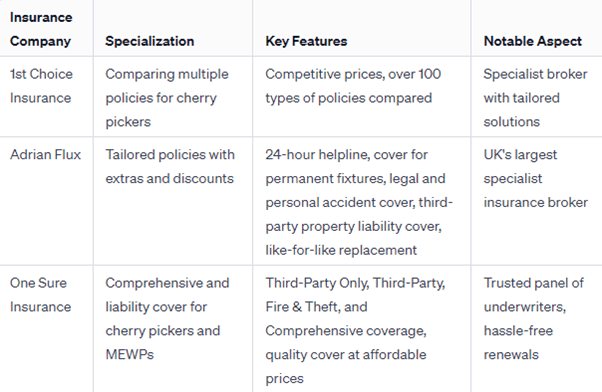

Selecting the right insurance provider for your van cherry picker is not an option. It’s not just about finding the lowest price but also about ensuring reliability and comprehensive coverage. Here is a short comparison of 3 major insurance companies in the UK.

Claims and maintenance.

Claims and maintenance.

Knowing how to effectively file an insurance claim in case of any accidents is needed. It’s important to be well-acquainted with your insurance provider’s procedures for claims to ensure a prompt and hassle-free experience. Additionally, keeping your van cherry picker in top condition is not only essential for safe operation but also plays a significant role in insurance matters. Insurers often view well-maintained equipment more favourably, which can positively impact the outcome of your claims.