VAT – How to make your money go further.

As a sole trader working in the UK, managing your finances effectively is key to ensuring the growth and sustainability of your business. One area that can have a significant impact on your bottom line, if used correctly, is Value Added Tax (VAT). Understanding how VAT works and how to leverage it can help you save money, manage cash flow, and make strategic decisions that stretch your money further.

Let’s break down why VAT is essential for you and how to use it to grow your business.

What Is VAT and Why Should You Care?

VAT is a tax applied to most goods and services sold in the UK. It is charged at different rates depending on the product or service. As a business owner, you may need to charge VAT on your services if your annual turnover exceeds the VAT registration threshold, which, as of 2024, is £85,000. Once you’re VAT-registered, you must charge VAT on the services you provide and pay VAT on the goods and services you purchase for your business.

The standard VAT rate in the UK is 20%, but there are reduced rates for specific items, which could greatly benefit your business. Certain safety equipment may qualify for a reduced VAT rate, which means you can purchase it at a lower cost.

Claiming back VAT

- Improved Cash Flow Being VAT-registered can also help with cash flow. If your clients pay you VAT on your services, this money technically belongs to HMRC, but you hold onto it until your VAT payment is due. This can give you a short-term boost in cash flow, allowing you to cover short-term expenses or invest in your business before the VAT is due.

- Better Business Credibility VAT registration can also lend credibility to your business, especially if you work with larger companies or commercial clients. Many larger firms expect to deal with VAT-registered businesses, so registering for VAT could open up new opportunities for high-value contracts.

How You Can Use VAT to Grow Your Business

By understanding how VAT works, you can make more strategic financial decisions. Here’s how:

1. Understand the impact of VAT on your purchases. This will help you make smart decisions when buying items like access platforms or chainsaws. You can reclaim VAT on larger investments, making the cost more manageable and allowing you to invest in equipment that improves efficiency.

2. Consider VAT when setting prices for your services. Price your services competitively, factoring in your costs and the VAT you’ll need to charge. Highlight the added value you bring to justify the VAT to your clients.

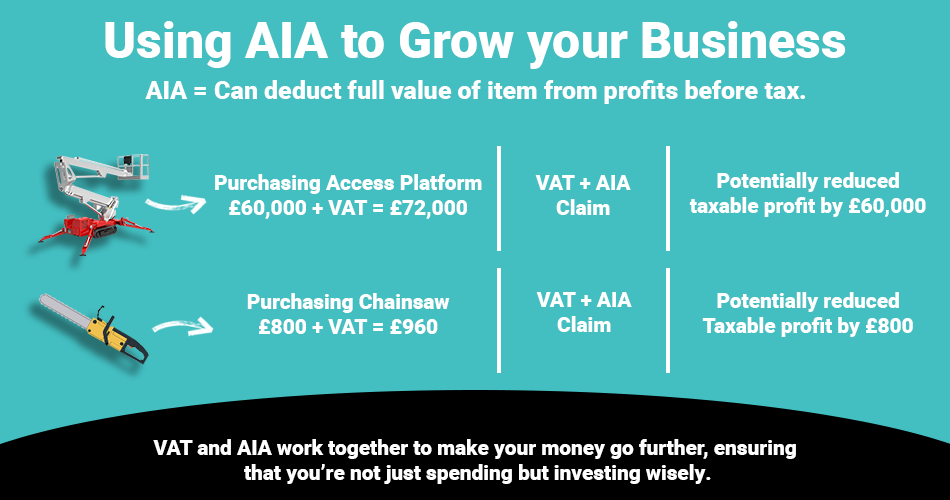

3. Take advantage of tax breaks and allowances. For example, you can claim the Annual Investment Allowance (AIA), which allows you to deduct the full value of qualifying equipment from your profits before tax. This can help you save money on equipment purchases.

“You can claim capital allowances on items that you keep to use in your business – these are known as ‘plant and machinery’.” (Gov.uk, 2024)

“In most cases, you can deduct the full cost of these items from your profits before tax using annual investment allowance (AIA).” (Gov.uk, 2024)

AIA + VAT

Stretch Your Money Further

For you, understanding VAT is not just about staying compliant—it’s about using every available opportunity to grow your business. By reclaiming VAT on your purchases, improving cash flow, and benefiting from tax breaks like AIA, you can make your money last longer and stretch further.

So, whether you’re purchasing essential equipment or pricing your services, always keep VAT in mind as a tool that can help your business thrive in the competitive UK market.

By mastering VAT and other tax opportunities, you’ll position your business for sustainable growth while keeping more money in your pocket.